With international travel slated to resume by the end of 2021, the notion of getting a loan to go travelling to a foreign land is again a possibility.

The Australian federal government has revealed a four-phase roadmap to reopening the country. International travel resumes with a trigger of 80% vaccination, allowing the final phases to become a reality.

With this announcement, several high-profile destinations are set to establish travel bubbles with Australia. Travel looks to be set with our commonwealth cousins of New Zealand, the United Kingdom, and Canada, as well as the United States, Fiji, and the orient nations of Singapore and Japan. To say the notion of interstate borders opening allows freedom of movement within Australia itself.

It’s an exciting notion for everyone. Some of us have family we have not been able to see, others have awaited a travel experience since before the onset of COVID, most of us just need a break.

Understandably, most Australians had several issues to face during the height of the pandemic. Having gone through various lengths of lockdown, disruptions to work and home life, as well as the financial repercussions that came with it all, the thought of a travel break is much needed but represents a financial hurdle.

The Cost of Travel in 2021 and Beyond

The good news about domestic and international borders opening is that there a multitude of holidays that suit every price point. The limit is purely what you can imagine.

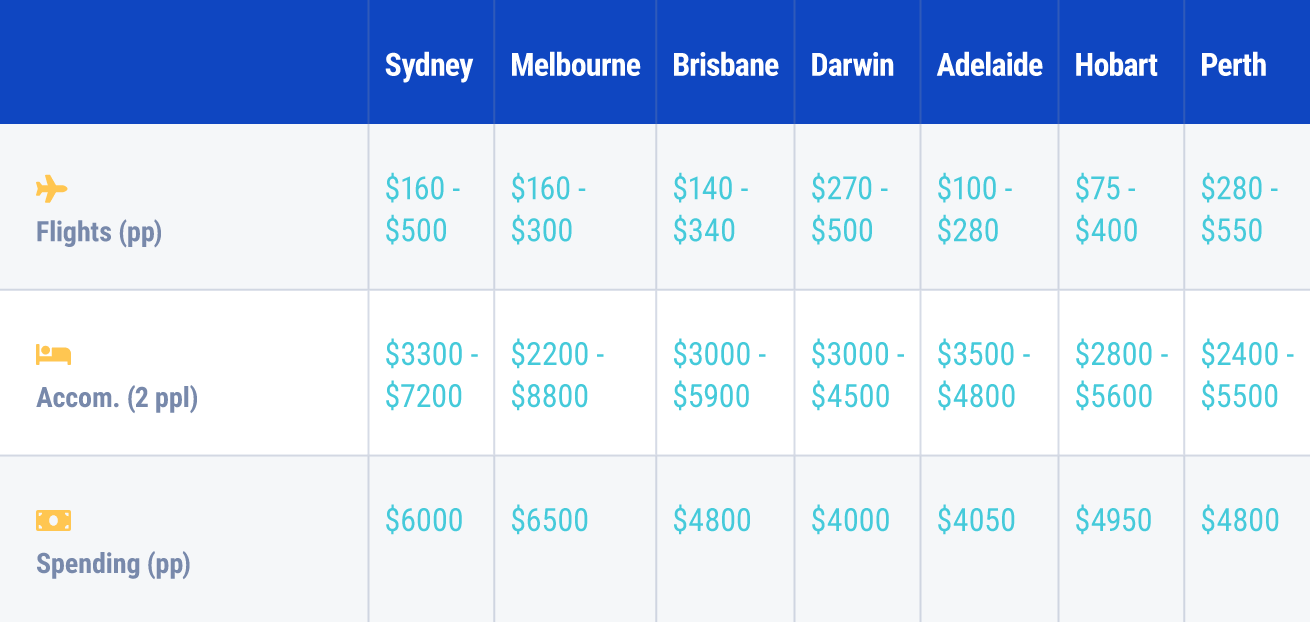

In order to see beyond the horizon, we’ve put together a basic list of destinations and expected expenses to help decide on what kind of loan to go travelling you’ll need.

International

Based on average prices for departure cities of Sydney, Melbourne and Perth for a four-week holiday paid two months in advance.

(Flights = One Way fare)

Domestic

Based on average prices for departure cities of Sydney, Melbourne and Perth for a four-week holiday paid two months in advance.

(Flights = One Way fare)

How a Personal Loan is the Smart Way to Travel

Like all major things, the most common hurdle is simply a lack of needed cash flow at the time. The simple and easy solution to this is a low-rate personal loan to not only cover expenses but also give you the financial freedom to really make the most of your travel experience.

OurMoneyMarket makes it easy for you to access a loan to go travelling across the world and holiday like you deserve, without the back-and-forth delays of applying face-to-face and requiring excessive qualifying criteria.

Simply put, access up to $75,000 in funds whilst our entirely online service means your application, submission and loan management are accessible to you 24/7.

Additionally, you can determine loan period (up to 7 years), weekly, fortnightly or monthly repayments, putting you in a position to manage your finances.

And, with interest rates on a per annum basis, arrange your repayments to pay within the first 12 months and you gain even more value for money.

OMM Personal Loans

What makes an OMM personal loan ideal for everyone looking to travel beyond their backyard. Hailed with awards from Canstar, RateCity and Mozo for excellent credit personal loans, outstanding value and expert choice 2021, take comfort in knowing you have access to one of Australia’s best lenders.

Our personal loan services are eligible for Australian permanent residents or citizens over the age of 18-years-old with no defaults or bankruptcy.

Get started with our preliminary quote service which has no impact on your credit score and will show you just how easy it is to jet off across the globe.