Motorcycle finance for riders new and old. Every rider knows what it means to feel the liberation of the never-ending road is the adventure of a lifetime. But for many, getting the keys to the bike is still a major roadblock.

Between the cost of a motorbike alone, bundled in with the additional costs such as permits, protective clothing, registrations, and maintenance costs, getting on the road is getting harder for many.

It seems, however, more Australians than ever are getting on two wheels. During 2020, we saw an exponential increase in motorbike sales, by as much as 22.2%. And that’s despite a global pandemic and the wake it caused to the national economy. In 2020 alone, 100,000 bikes were sold across the country. And with them, so too had the demand for motorcycle finance.

The Cost of the Keys

For many, buying the first bike or even a much-needed upgrade can mean a significant and upfront amount to cover the costs.

So, what are the foreseeable costs and how much do you need to cover them and get on the road?

The Six Expenses of Owning a Motorbike:

- The motorbike

- Safety clothing and other gear

- Maintenance and repairs

- Insurance

- License/ permit/ registration

- Fuel and oil

While some of these are upfront and others ongoing, the whole sum can be intimidating.

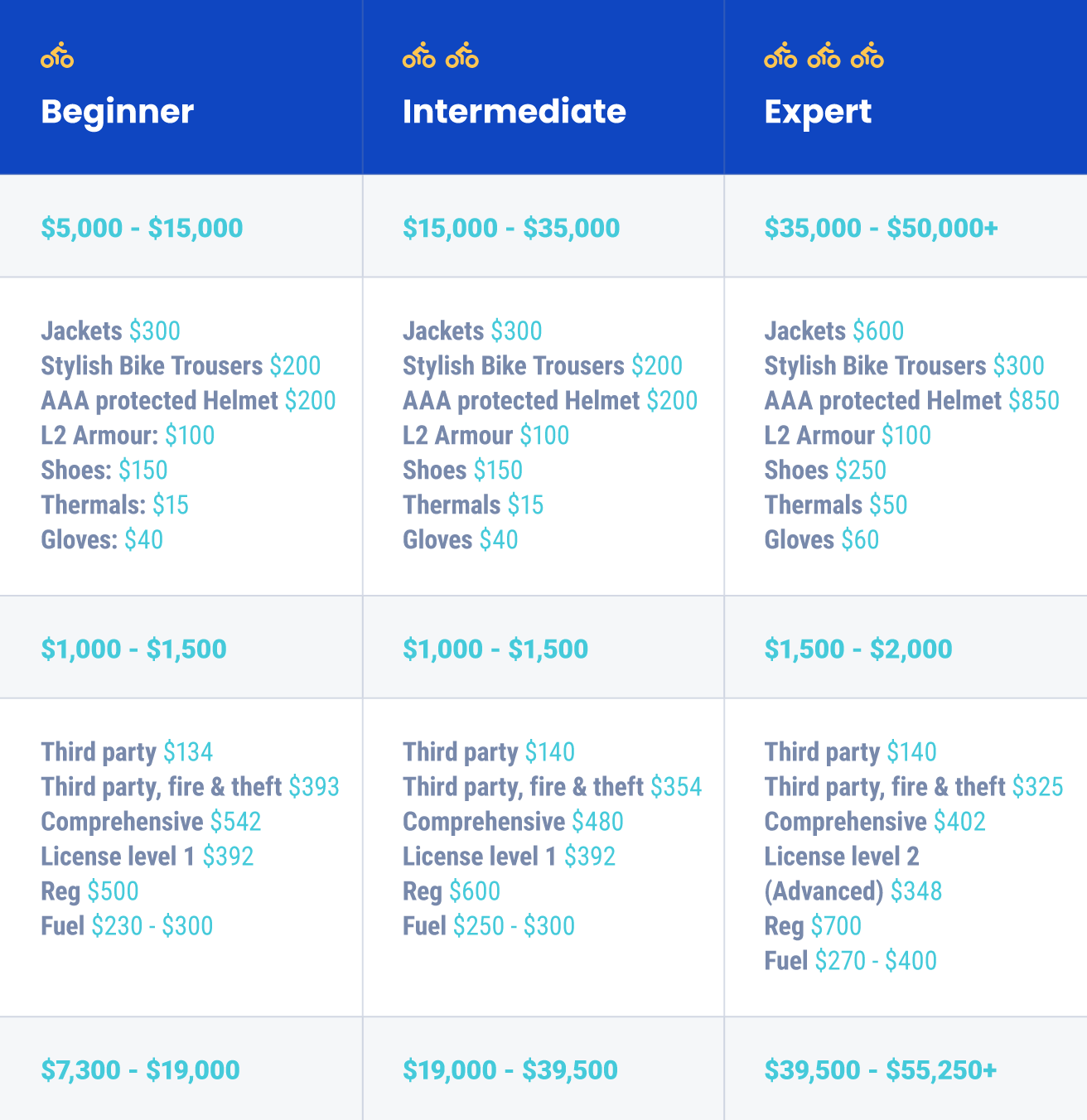

In order to make a safe assessment of the expected costs of buying a motorbike, see our table on the three tiers of riders. The first is a new rider with an entry-level bike, intermediate, and expert. Each with its own level of quality expectation.

*Online retail figures 2021 & rounded

How a Motobike Loan is the Smart Way to Ride

Like all major purchases, the most common hurdle is simply a lack of needed cash flow at the time. The simple and easy solution to this is a low-rate personal motorbike loan.

With OurMoneyMarket, can help you buy the motorbike of your dreams without the back-and-forth delays of applying face-to-face and requiring excessive qualifying criteria.

Simply put, access up to $75,000 in funds with application, submission, and loan management all available online through the OMM website, meaning you can determine loan period (up to 7 years), weekly, fortnightly, or monthly repayments, and access your account 24/7.

OMM Personal Loans

What makes an OMM motorcycle finance ideal for anyone seeking to buy a new motorbike. Hailed with awards from Canstar, RateCity, and Mozo for excellent credit personal loans, outstanding value, and expert choice 2021 take comfort in knowing you have access to one of Australia’s best lenders.

Our personal loan services are eligible for Australian permanent residents or citizens over the age of 18-years-old with no defaults or bankruptcy.

Get started with our pre-approval service which has no impact on your credit score and will show you just how easy it is to get the motorbike of your dreams.

If you have some queries, look to our FAQs and find the answer you’re looking for, or head to our blog for more articles,